Fires can strike anywhere, so it is important to be ready for anything. It’s equally important to consider all the ways you can prevent a fire from ever happening.

To protect your home and those you love, you need to learn how to prevent fire from setting in. There are many things you can do to protect your home from fire. These include smoke alarms and fire extinguishers. You also have an escape plan. Fireproof safe deposit boxes will protect your valuables.

There are simple things you can do to make yourself safer.

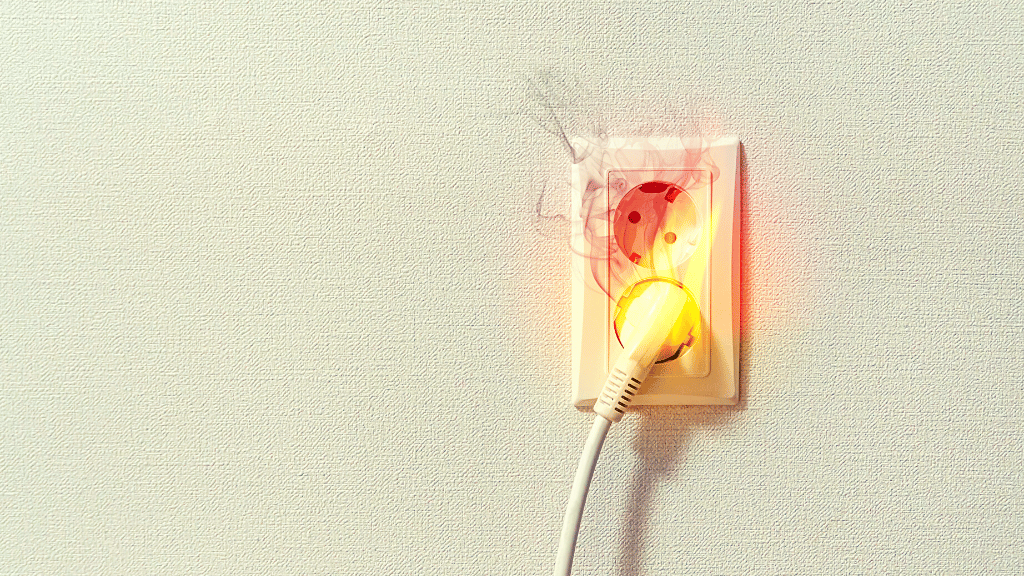

Unplug Items That You Aren’t Using

An excess amount of electricity in your home could cause fire hazards. Computers, TVs, and other electronic devices use electricity even when they aren’t on. They can either experience a surge of electricity or overheat, causing a fire.

They are also provided with electricity to keep them lit. You can reduce the chances of having a fire by unplugging them when they aren’t being used.

Use surge protectors

You should make sure all your electronics are plugged into surge protectors. By plugging your electronics into surge protectors, you can prevent that electricity from getting to the items and starting a fire.

Surge protectors keep that extra out. They can reduce the risk of a fire starting in the first place and the strength of the fire if it does start.

Never leave flames unattended

You should always be watching what you are doing when you cook, light candles, or use any type of heat or flame. You should never walk away from the stove when you’re cooking. You should also be on the lookout for your fireplace if you light it.

You can quickly identify if there is a problem with these flames by keeping your eyes open. This will allow you to quickly identify the problem and ensure your family’s safety. You should also keep a smoke alarm and a fire extinguisher in this area.

Keep Flammable Items Out of Heat

Avoid excessive heat and flame with fragile items such as fabrics, paper, or even hair. When you light a fire in the fireplace, it is important to protect your hair and clothes.

Keep the papers away from the wax melter. Also, you need to be vigilant for any potential problems. It’s not a good idea to let a fire start anywhere. This means that you need to be aware of heat sources and any other objects near them.

Do not smoke in your home

It is important that you smoke in a well-ventilated area. Also, make sure to put the cigarette out before throwing it away. There are many additives and materials in cigarettes that can burn even after you have put them out.

The flame could then light up outside or inside your home, igniting a fire. You can reduce the risk by smoking outside. Also, make sure you remove all ashes from your cigarette before you throw it away.

Put out the Fire

It’s crucial to be vigilant when using a fireplace. It’s important to ensure that you have the fire out before you leave the area. This will allow you to keep an eye on the fireplace to ensure that it doesn’t re-light.

Logs and embers can continue smoldering and burning, and logs may have flames that appear much later. Before you go to bed, make sure to completely smother any fire.

Reduce the clutter

Fires can start unassisted and can also spread to a large extent if there is too much clutter in your home. You can reduce your risk and make it easier to save your home from a fire by keeping less clutter.

You can make the fire spread if there are too many items in the space. Make sure your home is a bit more organized by getting rid of any excess clutter.

Clean out Lint and Change Filters

Heating systems require a filter to function properly. But how often should you change that filter? It is important to change the filter often because lint can build up and cause the furnace to ignite.

The same applies to your dryer. Every time you wash your laundry, you should make sure to clean out the dryer filter. A small amount of lint can cause a fire.

If you leave the house, turn off heated appliances

Your dryer and dishwasher use a lot of heat. Heated blankets and space heaters also use heat. These are items that you don’t want running while you’re away from home. They could catch fire and start a massive fire that you won’t be able to see.

If you are present in your home and awake, you can stop it from turning into a major fire. But if you aren’t there or asleep, that won’t happen.

Check the Electrical frequently

This doesn’t mean that you have to go into your walls to check for electrical wires. However, you should inspect any visible wiring. You should monitor the outlets in your house and be alert for any sudden problems.

This could indicate a problem with the wall. You should inspect your electrical belongings for frayed or damaged cords. These are signs that there may be a problem and you shouldn’t plug them into your electrical system.

fireproofing materials are one of the best ways to reduce your home’s risk of fire. Fireproof materials are designed to resist fire and keep it from spreading. These materials can be used in walls, floors, and ceilings to provide an extra layer of protection in a fire. You should also make sure any electrical wiring in your home is up to code and use fireproof insulation to help protect your home.

Keep the Debris down

It is important to keep debris from your exterior. Firewood, leaves, or other flammable materials, can easily catch fire from sparks or ashes.

These items should not be allowed near your home as they can spread flames throughout your house, creating a large fire. It’s not something you want to experience and it is easy to reduce the risk.

Keep oil and gas away from flames and sparks

You should keep cooking oil away from your stove and other potential ignition points. Gas that you keep in your garage for your car, lawnmower, or any other purpose is the same.

Keep the gas from sparking or burning. You can be more prepared by keeping these items in containers that are approved and away from any potential reactions.

Have Your Furnace Inspected

You can’t do everything to protect your home. It is important to have your furnace checked regularly and schedule regular maintenance.

An expert can ensure that your furnace continues to work properly and doesn’t put you at risk of fire. Broken furnaces can pose a danger to your safety and that of your home. Maintenance and monitoring can prevent problems from ever happening.

Have an Emergency Plan

Finally, it’s important to have an emergency plan in place in case of a fire in your home. Make sure everyone in the home knows the plan and is familiar with the best ways to escape in case of a fire. You should also make sure to have an emergency kit with basic supplies like a fire extinguisher, a flashlight, and a first aid kit in case of an emergency.

By following these tips, you can help reduce your home’s risk of fire. Taking these steps can help ensure that your home is safe from fire and that you and your family are prepared in case of an emergency. If you ever plan to sell your home, you want to make sure it is safe enough for the next home buyer.

Remember, fire can cause massive destruction and the loss of life, so it’s important to take steps to reduce the risk of fire in your home.